MSME Loan Scheme (Ministry of Micro, small & Medium Enterprises) – Best Business Loan for Micro, Small and Medium Enterprises – MSME Loans, also known as Micro, Small, and Medium Enterprise Loans, are forms of loans available to entrepreneurs and business owners as MSME business loans. This form of loan provides you with working capital that you can utilize for a variety of things, including buying new goods, purchasing new equipment, paying your employees’ salaries, and expanding your firm.

In India, a variety of lenders provide MSME loans to its consumers. Interest rates differ from one bank to the next. This scheme is started by The Ministry of Micro, Small & Medium Enterprises. It will help these businesses in growth and diversification.

MSME Loan Details

| MSME Loan Interest Rate | 7.65% p.a. onwards |

| Loan Amount | Rs.50,000 onwards |

| Loan Tenure | Up to 15 years |

| Processing Fee | Subject to the lender |

The Government of India changed the definition of MSME loan scheme and announced it on May 13, 2020. Investment has been replaced with Investment and Annual Turnover as the MSME classification requirement. The Indian government recently enhanced the investment ceiling for MSME classification. This means that more businesses and firms will be able to benefit from MSME programmes.

| Also Read |

Udyogini Scheme for Women Entrepreneurs – Interest Free Loan Scheme

Pradhan Mantri Suraksha Bima Yojana (PMSBY) – Apply Online for PMSBY 2022

Micro, Small, and Medium Enterprises (MSME) loans can be used to expand existing businesses or start new ones. MSME loans have interest rates that start at 7.65% per annum. The loan amount approved can be as low as Rs.50,000 and as high as a few crores. The loan repayment period might be up to 15 years depending on the loan amount approved.

MSME Loan Interest Rates by Top Banks in 2022

| Bank Name | Interest rate |

| Oriental Bank of Commerce | 10.70% p.a. onwards |

| Andhra Bank | At the discretion of the bank |

| ICICI Bank | 13% p.a. onwards |

| Central Bank of India | 11.25% p.a. onwards |

| Indian Bank | 9.75% p.a. onwards |

| Punjab and Sind Bank | 9.95% p.a. onwards |

| Punjab National Bank | At the discretion of the bank |

| State Bank of India | 7.65% p.a. onwards |

| Syndicate Bank | At the discretion of the bank |

| UCO Bank | 8.85% p.a. onwards |

| Union Bank of India | At the discretion of the bank |

| United Bank of India | 10.25% – 16.25% p.a. |

MSME Loan Advantages

- The majority of MSME loans do not require collateral.

- Online approval and disbursement of the loan money is quick.

- An extended contract that can last anywhere from 12 to 60 months.

- Interest rates are lower.

- Documents required for an MSME loan application

- Your financial institution’s net banking website makes it simple to manage your loan.

- Pre-approved proposals

Characteristics of MSME loan

- Accessibility – Obtaining starting cash, capital to sustain an existing business, or funds for expansion might be one of the most difficult tasks you will face as a business owner. An MSME loan is simple to obtain, and the entire process is painless. The loan amount is disbursed swiftly with minimal documentation. When you’re in desperate need of cash, this can help.

- Lower Interest Rates – Every dollar saved is a dollar earned. Nobody wants to spend a fortune paying outrageous interest rates. MSME loans have low interest rates, making them a popular financial product.

- Loans without collateral – MSME loans are collateral-free, which means you don’t have to put up any collateral.

- Collateral-free loans – MSME loans are collateral-free, which means you don’t have to put up any collateral to get one. MSME loans are designed to assist small firms and increase their output, hence they do not require collateral from applicants. MSME loans are therefore an excellent source of capital.

- Flexibility – MSME loans are typically employed by firms for short-term needs. It is adaptable because no long-term commitment is required. Having a short-term commitment allows you to efficiently manage cash flow and allocate available resources.

MSME loans are a good source of money for entrepreneurs who wish to avoid liquidation of control in such circumstances because they are meant to address the short-term needs of small enterprises when there is a severe need. This gives them complete control over their company.

MSME Loan Eligibility

To get eligible for an MSME loan, you must meet the qualifying conditions stated by your lender. The requirements differ from bank to bank and even depending on the type of programme available. However, the following are the general requirements you must meet:

Composite Criteria: Investment in Plant & Machinery/equipment and Annual Turnover

| Classification | Micro | Small | Medium |

| Manufacturing Enterprises and Enterprises rendering Services | 1.) Investment in Plant and Machinery or Equipment: Not more than Rs.1 crore 2.) Annual Turnover: not more than Rs. 5 crore | 1.) Investment in Plant and Machinery or Equipment: Not more than Rs.10 crore 2.) Annual Turnover : not more than Rs. 50 crore | 1.) Investment in Plant and Machinery or Equipment: Not more than Rs.50 crore2.) Annual Turnover: not more than Rs. 250 crore |

Documents required to apply for a MSME Loan

- Application Form: MSME Loan application form duly filled and signed by all the applicant(s).

- Photographs: passport size photographs of all the applicant(s)

- Identity Proof: Identity proof of all the applicant(s) applying for the MSME Loan. This point of MSME Loans documentation can include:

- Pan Card

- Aadhar Card

- Passport

- Voters Id Card

- Driving License

- Residence Address Proof: the residential address proof would be for all the applicant(s) applying for the MSME Loan. The acceptable address proof is:

- Passport

- Utility Bill – Telephone or Electricity bill not more than 3 months old

- Ration Card

- Aadhar Card

- Driving License

- Proof of Applicant(s) Age: Even if the business is a corporation, the partners, people, or directors participating in the corporation must present proof of age as one of the documents necessary for MSME Loans.

- Before the loan is approved, a business plan is required to determine your company’s industry, and long-term growth potential.

- Bank Statement: The company’s bank account statement for the previous six months.

- Income Proof: This is the business’s income proof, which could include tax returns with profit and loss accounts and balance sheets.

- Proof of Registration: Proof of registration, which could be any of the following, is required for MSME Loans.

- Sales Deed

- Copy of Licenses & Certificates

- Rent agreement

How to apply for MSME Loan

There are two methods for submitting an MSME loan application.

- If the lender offers an online application, you can complete the form and submit it through the lender’s website.

- Alternatively, you can go to your local bank and ask for an application form. You can call beforehand to find out what documentation is required.

MSME Online Registration Process

The procedures for registering as a new user for MSME are outlined below.

- Go to Official website of Ministry of Micro, Small and Medium Enterprises or You can Click here

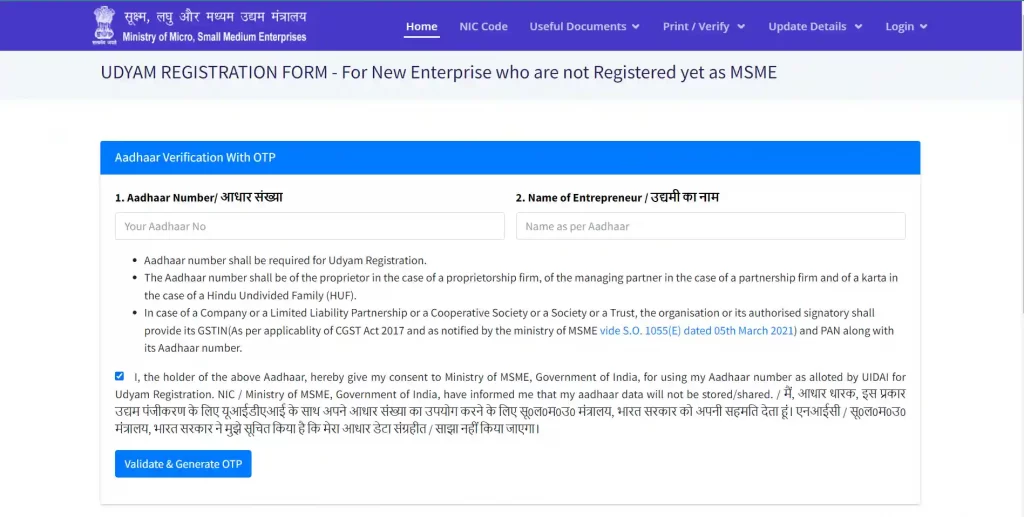

- Click on ‘New Entrepreneurs who are not yet registered as MSME or those with EM-II‘ if you haven’t already.

- You must enter Your Name and Aadhaar Number before clicking ‘Validate and Generate OTP.’

- Your cell number will receive a One-Time Password (OTP). To authenticate, enter the OTP.

- After that You must next provide the details of your PAN, as well as the organization to which you belong, and authenticate it.

- Provide your personal information as well as information about the industry or plant where you work next.

- After you’ve entered all of your information, click ‘Submit and Get Final OTP.’ Your cellphone number will receive an OTP.

- After validating the final OTP, Your MSME Online Registration Process is done.

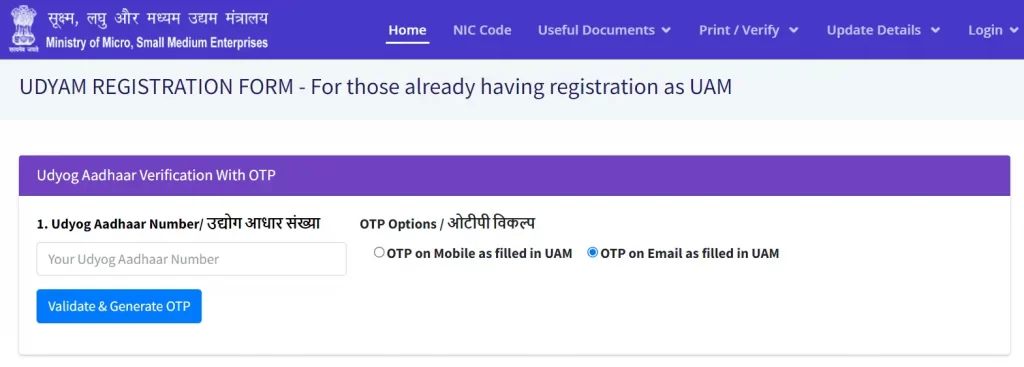

Registration For Entrepreneurs Already Having UAM

The Ministry of MSME has notified a one page Udyog Aadhar Memorandum (UAM) through a Gazette of India on 18.09. 2015 as part of initiative to ease of Registration of MSMEs.

- If you’ve already registered as a UAM, Go to Official website of Ministry of Micro, Small and Medium Enterprises or You can Click here

- Select between ‘For those who have registered as UAM’ or ‘For those who have already registered as UAM through Assisted filing.’

- Your Aadhaar number must be entered.

- You can have the OTP sent to your registered mobile number or email address.

- After you’ve entered the OTP, click ‘Validate and Generate OTP.’

- Your registration will be finished once you enter the OTP.

Useful Links for MSME Loan Scheme

| MSME Loan Online Registration | Click here |

| Download MSME Loan PDF Description | Click here |

| MSME Official Website | Click here |

| Our Website | Click here |