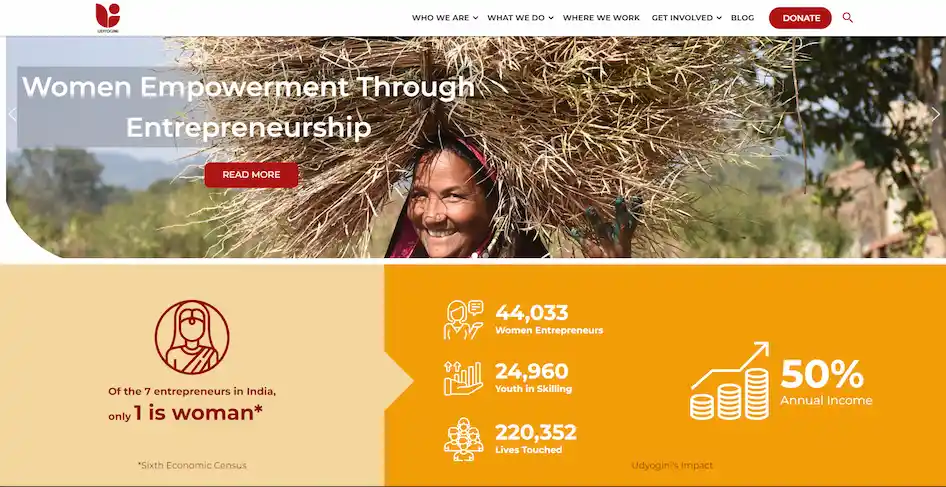

Udyogini Scheme for Women Entrepreneurs: Interest Free Loan Scheme – Udyogini scheme was created by women entrepreneurs and the government to help women entrepreneurs in India. This programme encourages and pushes underprivileged women to start businesses by giving them financial assistance. This programme primarily benefits and funds women who live in rural and underdeveloped areas. Udyogini Schemes assist individuals and families to enhance their income while also contributing to the country’s general progress.

Under Women from all walks of life are granted interest-free loans without discrimination or bias. Banks also provide interest-free loans to women who work in agriculture. KSWDC (Karnataka State Women’s Development Corporation), Punjab and Sind Bank, Saraswat Bank, and a slew of other commercial and public sector banks are among the major lenders. In addition to providing financial assistance, this Udyogini Scheme also focuses on arranging and delivering professional development training programmes for women.

What is the Udyogini Scheme?

The Udyogini Scheme was developed by the Indian Government with a secular goal of motivating and assisting women entrepreneurs in deprived areas. Udyogini Yojana primarily assists poor and illiterate women in rural regions in becoming financially self-sufficient. The government encourages women’s business and empowerment by providing financial aid and skill training. This will increase the participation of Women Entrepreneurs in Development of the nation.

| Also Read |

Pradhan Mantri Suraksha Bima Yojana (PMSBY) – Apply Online for PMSBY 2022

MSME Loan Scheme – Best Business Loan for Micro, Small and Medium Enterprises

Highlights of Udyogini Scheme

- Udyogini Scheme offers interest-free loans to women from all sections of society.

- Each district’s Corporation branch can provide the applicant with a loan application.

- 88 small businesses will receive interest-free loans, including grocery stores, bakeries, pickle shops, fish markets, sewing shops, beauty salons, and STD booths.

- The loan amount under Udyogini Yojana was increased to Rs. 3,00,000 from Rs. 1,00,000 previously.

- The government is proposing a loan subsidy of 30% in this Udyogini Scheme.

- Udyogini conducts a review to see whether the beneficiary selection process was transparent and fair.

Main Objective of Udyogini Scheme

- Encourage women to take out loans from banks and other financial organizations to start their own businesses.

- Reduce the cost of financial assistance for women from the SC & ST or special category.

- Without discrimination or bias, grant interest-free loans to eligible women beneficiaries.

- Ensure the recipients’ skill improvement through EDP Training.

- Prevent women from seeking high-interest loans from private money lenders or other financial organizations.

Advantages of Udyogini Yojana 2022

- 7047 women entrepreneurs will benefit from the programme.

- The programme provides assistance to 5432 youngsters.

- So far, 1698 communities have been covered.

- So far, 53762 producers have been contacted.

- Karnataka State Women’s Development Corporation (KSWDC), Punjab and Sind Bank, Saraswat Bank, and a few more private and public sector institutions are now offering the scheme.

- Women in agriculture, retail, and small commercial operations are eligible for interest-free loans.

- Before the loan is released, the beneficiary ladies receive EDP training for three days after the loan is approved.

The government has directed financial institutions, including banks, to provide interest-free loans to women from all walks of life without discrimination or preference under this scheme.

| Loan amount | Max amount up-to ₹3 lakh |

| Interest rate | Very competitive (highly subsidized or free loans to special category) |

| Annual family income (applicant) | ₹1.5 lakh or less |

| Age limit | Min. 18 years and max. 55 years |

| For widows or disabled women | No income limit |

| Collateral | Not required |

| Processing fees | Nil |

Eligibility Criteria for Udyogini Loan Scheme

What is the eligibility for applying for the Udyogini Scheme? A woman who is applying for Udyogini Loan Scheme should fulfill following eligibility criteria to get benefit of this Yojana:

- The applicant must be female.

- She should be between the ages of 18 and 55.

- The applicant’s annual family income should be less than Rs.1.5 lakh.

- There is no income ceiling for women who fall into particular categories such as disabled, widowed, or poor.

- Businesses in the SSI sector, merchants, manufacturers, self-employed professionals, traders, and others are eligible.

Documents Required for Udyogini Scheme

- Filled Application Form

- Birth Certificate

- Caste Certificate

- Income Certificate

- Aadhaar Card

- Ration Card

- BPL card

- Copy of a bank statement (bank name, branch name, holder name, account, MICR and IFSC code).

Udyogini Official Portal udyogini.org

Udyogini has launched a new portal (udyogini.org) for the detailed information about resources of this scheme. This Udyogini Portal provides information about the plan and related services.

How to Apply for Udyogini Scheme 2022

The steps below should be followed:

- Either download or obtain an application form for the Udyogini Yojana from the bank.

- Complete the form completely.

- Include all required documents with the form, as specified and required on the form.

- The application for the loan has been completed. You will receive the funds once you have been accepted.

List of Businesses supported under Udyogini Yojana

Here is a list of 88 Business Categories supported under the Udyogini Scheme – Various financial organizations, such as co-operative banks, Regional Rural Banks (RRBs), and commercial banks, offer loans under the Udyogini Scheme at competitive interest rates. Only women entrepreneurs are eligible for assistance from the corporation to manage their businesses. The application form for the Udyogini Scheme is available on the bank’s official websites.

- Agarbatti Manufacturing

- Audio & Video Cassette Parlor

- Bakeries

- Banana Tender Leaf

- Bangles

- Beauty Parlor

- Bedsheet & Towel Manufacturing

- Book Binding And Note Books Manufacturing

- Bottle Cap Manufacturing

- Cane & Bamboo Articles Manufacturing

- Canteen & Catering

- Chalk Crayon Manufacturing

- Chappal Manufacturing

- Cleaning Powder

- Clinic

- Coffee & Tea Powder

- Condiments

- Corrugated Box Manufacturing

- Cotton Thread Manufacturing

- Crèche

- Cut Piece Cloth Trade

- Dairy & Poultry Related Trade

- Diagnostic Lab

- Dry Cleaning

- Dry Fish Trade

- Eat-Outs

- Edible Oil Shop

- Energy Food

- Fair-Price Shop

- Fax Paper Manufacturing

- Fish Stalls

- Flour Mills

- Flower Shops

- Footwear Manufacturing

- Fuel Wood

- Gift Articles

- Gym Center

- Handicrafts Manufacturing

- Household Articles Retail

- Ice Cream Parlour

- Ink Manufacture

- Jam, Jelly & Pickles Manufacturing

- Job Typing & Photocopying Service

- Jute Carpet Manufacturing

- Leaf Cups Manufacturing

- Library

- Mat Weaving

- Match Box Manufacturing

- Milk Booth

- Mutton Stalls

- Newspaper, Weekly & Monthly Magazine Vending

- Nylon Button Manufacturing

- Old Paper Marts

- Pan & Cigarette Shop

- Pan Leaf or Chewing Leaf Shop

- Papad Making

- Phenyl & Naphthalene Ball Manufacturing

- Photo Studio

- Plastic Articles Trade

- Pottery

- Printing & Dyeing of Clothes

- Quilt & Bed Manufacturing

- Radio & TV Servicing Stations

- Ragi Powder Shop

- Readymade Garments Trade

- Real Estate Agency

- Ribbon Making

- Sari & Embroidery Works

- Security Service

- Shikakai Powder Manufacturing

- Shops & Establishments

- Silk Thread Manufacturing

- Silk Weaving

- Silk Worm Rearing

- Soap Oil, Soap Powder & Detergent Cake Manufacturing

- Stationery Shop

- STD Booths

- Sweets Shop

- Tailoring

- Tea Stall

- Tender Coconut

- Travel Agency

- Tutorials

- Typing Institute

- Vegetable & Fruit Vending

- Vermicelli Manufacturing

- Wet Grinding

- Woolen Garments Manufacturing

Useful Links for Udyogini Loan Scheme

| Udyogini Portal | Click here |

| Our Website | Click here |

| Read Other Govt Schemes | Click here |